The Complexities of Jewelry Buyback Programs: A Comprehensive Guide

Related Articles: The Complexities of Jewelry Buyback Programs: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to The Complexities of Jewelry Buyback Programs: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Complexities of Jewelry Buyback Programs: A Comprehensive Guide

The allure of precious metals and gemstones has captivated humanity for centuries. As a result, jewelry has become a cherished possession, often representing significant milestones and sentimental value. However, life’s unpredictable nature can lead to circumstances where individuals find themselves needing to part with their treasured jewelry. This is where the concept of jewelry buyback programs emerges, offering a potential solution for those seeking to monetize their precious pieces.

This comprehensive guide explores the intricacies of jewelry buyback programs, providing insights into their workings, the factors influencing buyback prices, and the considerations individuals should weigh before engaging in such transactions.

Understanding Jewelry Buyback Programs

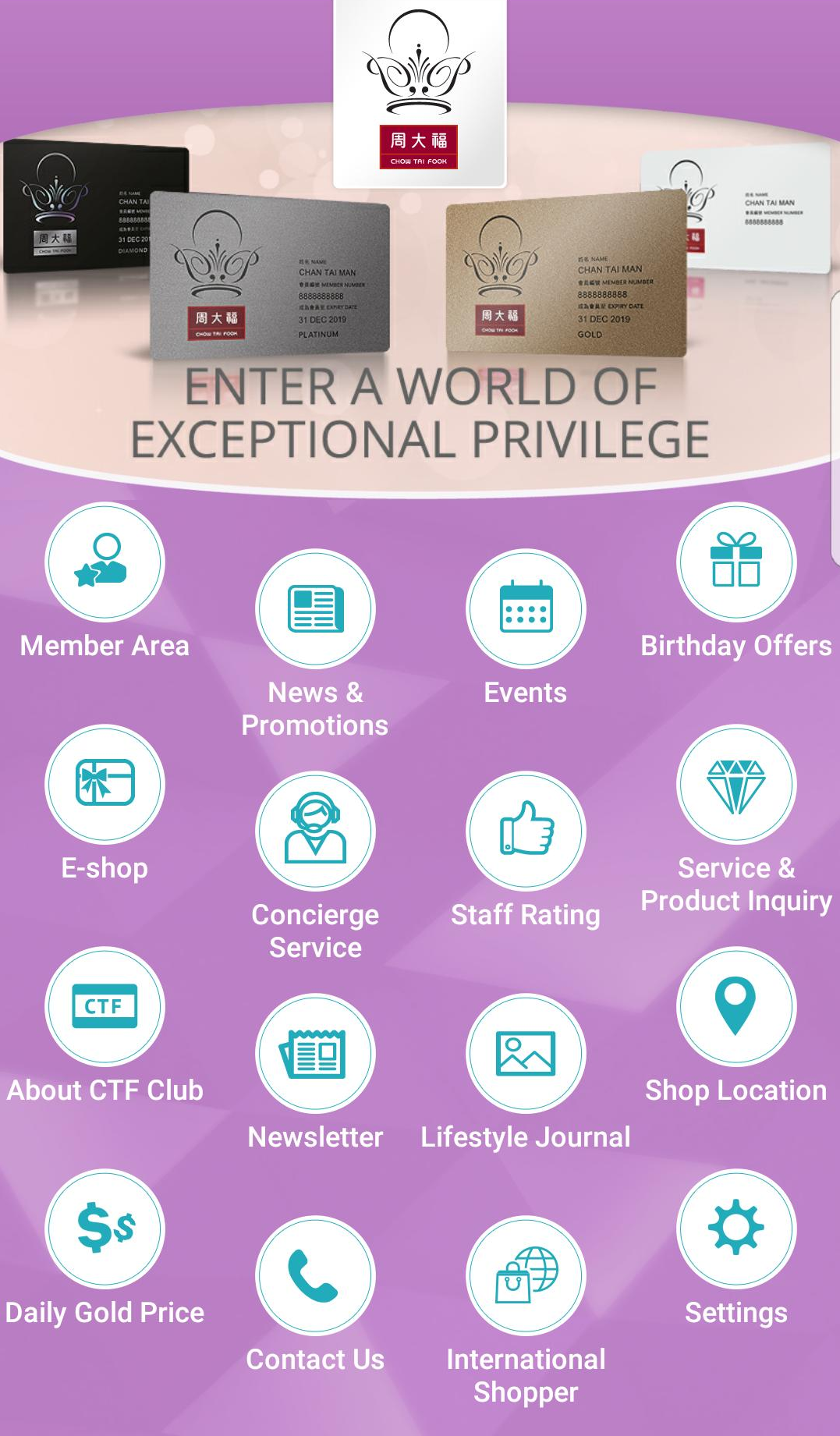

Jewelry buyback programs are offered by select jewelry retailers, pawn shops, and precious metal dealers. They provide a platform for individuals to sell their jewelry, receiving a cash payment in exchange. While the concept seems straightforward, several factors contribute to the complexity of these programs, influencing both the decision to participate and the ultimate value received.

Factors Influencing Buyback Prices

The price offered for jewelry in a buyback program is not a fixed value but rather a dynamic figure influenced by several key factors:

- Metal Purity and Weight: The primary determinant of value is the type and purity of the precious metal used in the jewelry. Gold, silver, platinum, and other precious metals are valued based on their weight and purity, expressed in karats or fineness.

- Gemstone Quality: Gemstones, such as diamonds, sapphires, rubies, and emeralds, contribute significantly to the overall value of jewelry. Their quality is assessed based on the 4Cs: cut, color, clarity, and carat weight. Higher quality gemstones command higher prices.

- Design and Style: The craftsmanship, design, and overall aesthetic appeal of the jewelry also play a role in determining its value. Vintage or antique pieces often hold higher value due to their historical significance and unique designs.

- Market Fluctuations: The ever-changing market conditions for precious metals and gemstones directly impact buyback prices. Fluctuations in global demand, supply, and economic factors can lead to variations in value.

- Retailer Policies: Each jewelry retailer or dealer has its own policies regarding buyback programs. These policies encompass aspects such as the types of jewelry accepted, the evaluation process, and the payment methods offered.

Why Do Jewelry Stores Offer Buyback Programs?

The motivations behind jewelry buyback programs vary depending on the retailer or dealer. Some may offer these programs as a customer service initiative, providing a convenient avenue for customers to dispose of unwanted jewelry. Others may see buyback programs as a means to acquire inventory for resale, potentially at a higher profit margin.

Evaluating the Benefits and Drawbacks

Before engaging in a jewelry buyback program, individuals should carefully consider the potential benefits and drawbacks:

Benefits:

- Convenient Liquidation: Buyback programs offer a convenient way to convert jewelry into cash, particularly when facing financial constraints or needing funds quickly.

- Market-Based Valuation: While buyback prices may not always reflect the full market value, they are typically based on current market conditions for precious metals and gemstones.

- Transparency and Professional Evaluation: Reputable jewelry stores often have experienced professionals who can accurately assess the value of jewelry, ensuring a fair and transparent evaluation process.

Drawbacks:

- Lower Than Market Value: Buyback prices are generally lower than what an individual might receive by selling their jewelry privately or through an auction. This is because retailers need to account for their own costs and profit margins.

- Limited Acceptance Criteria: Not all jewelry stores accept all types of jewelry for buyback. Some may have restrictions on the types of metals, gemstones, or designs they are willing to purchase.

- Potential for Unfair Practices: It is essential to choose a reputable jewelry store with a proven track record of fair and transparent practices to avoid potential exploitation or undervaluation.

Tips for Maximizing Value in a Jewelry Buyback

While buyback programs may not always offer the highest possible value, individuals can take steps to maximize their returns:

- Research and Compare: Compare buyback prices offered by different retailers or dealers to ensure you are receiving a competitive offer.

- Clean and Polish: Clean and polish your jewelry before taking it for evaluation. A well-maintained piece is more likely to receive a higher appraisal.

- Gather Documentation: If possible, provide any documentation, such as certificates of authenticity or appraisals, that can support the value of your jewelry.

- Negotiate: Don’t be afraid to negotiate with the retailer or dealer. They may be willing to offer a higher price if you demonstrate your knowledge of the market and the value of your jewelry.

FAQs about Jewelry Buyback Programs

1. What types of jewelry are typically accepted in buyback programs?

Jewelry stores typically accept gold, silver, platinum, and diamond jewelry. However, they may have specific requirements regarding the karat purity of the metal, the quality of the gemstones, and the design of the jewelry.

2. How are buyback prices determined?

Buyback prices are determined based on the current market value of precious metals and gemstones, the weight and purity of the metal, the quality of the gemstones, and the design and condition of the jewelry.

3. Are buyback prices fixed or negotiable?

Buyback prices are typically negotiable. While the retailer will provide an initial offer, you can negotiate to potentially secure a higher price, especially if you have documentation supporting the value of your jewelry.

4. What documentation should I bring to a jewelry buyback appointment?

Bring any documentation you have, such as certificates of authenticity, appraisals, or receipts, to support the value of your jewelry.

5. How do I choose a reputable jewelry store for a buyback?

Choose a reputable jewelry store with a proven track record of fair and transparent practices. Check online reviews, inquire about their policies, and ensure they have experienced professionals who can accurately assess the value of your jewelry.

Conclusion

Jewelry buyback programs offer a potential solution for individuals seeking to monetize their precious pieces. However, it is crucial to understand the intricacies of these programs, including the factors influencing buyback prices, the potential benefits and drawbacks, and the tips for maximizing value. By approaching buyback programs with informed decision-making and a focus on transparency and fairness, individuals can navigate this process effectively, maximizing their return while maintaining the integrity of their cherished possessions.

Closure

Thus, we hope this article has provided valuable insights into The Complexities of Jewelry Buyback Programs: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!