Navigating the Glittering Path: Understanding E-Way Bills for Jewellery Businesses

Related Articles: Navigating the Glittering Path: Understanding E-Way Bills for Jewellery Businesses

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Glittering Path: Understanding E-Way Bills for Jewellery Businesses. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Glittering Path: Understanding E-Way Bills for Jewellery Businesses

The Indian jewellery industry, a vibrant tapestry of artistry and craftsmanship, faces a unique set of logistical challenges. Ensuring the smooth movement of precious metals and exquisite designs across the country requires a robust and transparent system. This is where the e-way bill emerges as a crucial tool, streamlining the transportation process and bringing greater efficiency to the industry.

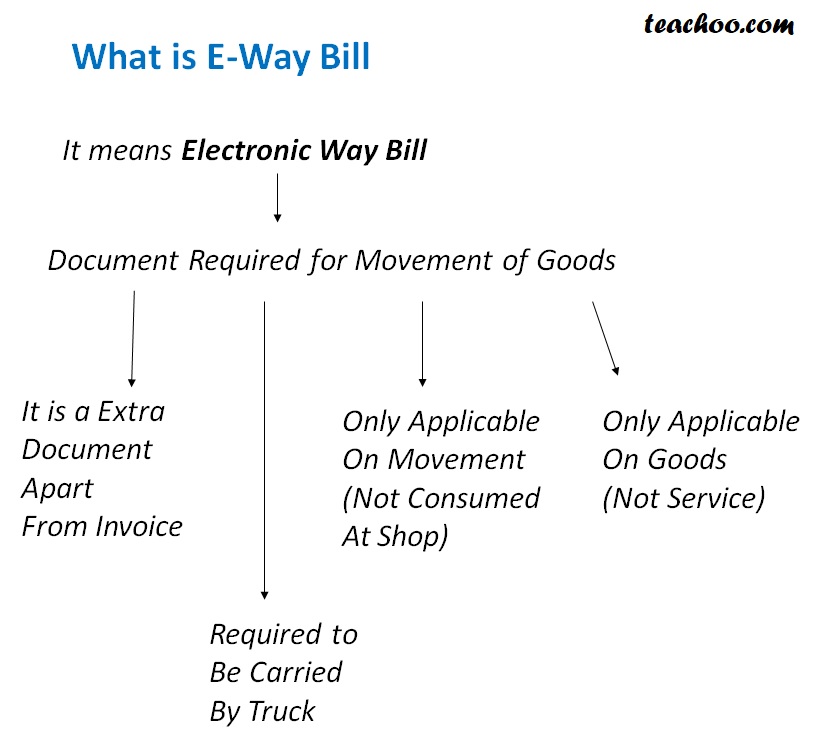

What is an E-Way Bill?

An e-way bill is a digital document generated online that accompanies goods during their movement within India. It serves as an electronic permit, eliminating the need for physical paperwork and simplifying the process of inter-state transportation. This digital revolution in logistics is a cornerstone of the Goods and Services Tax (GST) regime, aiming to enhance transparency, reduce delays, and facilitate a seamless flow of goods.

The Relevance of E-Way Bills for the Jewellery Sector

The jewellery industry, with its high-value goods and intricate supply chains, is particularly impacted by the implementation of e-way bills. Here’s why:

- Enhanced Security: E-way bills act as a deterrent against theft and fraud, making the transportation of jewellery safer. The digital trail created by the e-way bill provides a verifiable record of the goods’ movement, making it harder for illegal activities to occur.

- Streamlined Compliance: The electronic nature of e-way bills simplifies compliance procedures. Businesses can generate, manage, and track e-way bills digitally, eliminating the need for physical paperwork and manual processes. This streamlines operations and saves valuable time and resources.

- Reduced Delays: The digital system eliminates the need for physical checks at checkpoints, leading to faster movement of goods. This reduction in delays ensures timely deliveries and helps maintain the smooth flow of the supply chain.

- Transparency and Accountability: The e-way bill system provides a clear and transparent record of the movement of goods. This transparency fosters accountability within the supply chain, ensuring that all parties involved are aware of the goods’ location and status.

- Improved Tax Collection: The e-way bill system aids in effective tax collection by providing real-time data on the movement of goods. This data helps authorities identify and prevent tax evasion, leading to a more efficient and equitable tax system.

Understanding the E-Way Bill Process for Jewellery

The e-way bill process for jewellery involves several key steps:

- Registration: Businesses need to register on the GST portal to generate e-way bills. This involves providing relevant details about the business and obtaining a unique GSTIN (Goods and Services Tax Identification Number).

- Generation of E-Way Bill: Once registered, businesses can generate e-way bills through the GST portal or authorized third-party platforms. This requires providing details about the consignment, including the sender, receiver, goods description, quantity, value, and destination.

- Issuance of E-Way Bill: Upon successful generation, the e-way bill is issued with a unique e-way bill number. This number serves as a digital identifier for the consignment and can be used to track its movement.

- Transportation: The e-way bill must accompany the goods during transportation. This can be done electronically by displaying the e-way bill number on the vehicle or by providing a printout of the e-way bill.

- Verification: At checkpoints, authorities can verify the e-way bill using the unique number to confirm the legitimacy of the goods’ movement. This verification process ensures compliance with tax regulations and helps prevent illicit activities.

E-Way Bills for Different Types of Jewellery

The e-way bill process applies to all types of jewellery, including:

- Gold Jewellery: E-way bills are mandatory for the transportation of gold jewellery, whether it’s raw gold, finished ornaments, or semi-finished products.

- Diamond Jewellery: The transportation of diamond jewellery, including rough diamonds, polished diamonds, and diamond-studded ornaments, also requires e-way bills.

- Silver Jewellery: E-way bills are applicable for silver jewellery as well, including raw silver, silver ornaments, and silver-plated items.

- Other Precious Metals: The e-way bill system covers the transportation of jewellery made from other precious metals, such as platinum, palladium, and rhodium.

Key Considerations for E-Way Bills in Jewellery Businesses

While the e-way bill system offers numerous benefits, businesses need to consider these key aspects:

- Accurate Data Entry: Ensuring accurate data entry is crucial, as any discrepancies can lead to delays and penalties.

- Timely Generation: E-way bills need to be generated well in advance of transportation to avoid delays at checkpoints.

- Proper Documentation: Maintaining proper documentation related to the e-way bill, including the original invoice and supporting documents, is essential.

- Compliance with Regulations: Staying updated on the latest e-way bill regulations and guidelines is crucial to ensure compliance.

Frequently Asked Questions about E-Way Bills for Jewellery

Q1: Who is required to generate an e-way bill for jewellery?

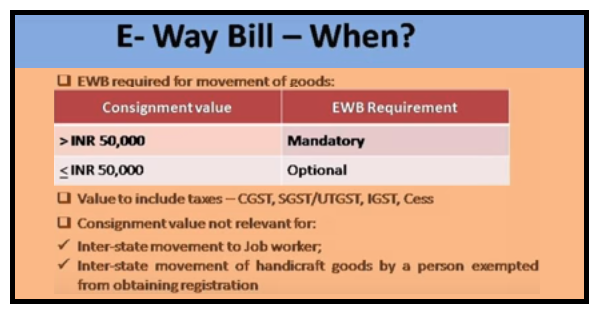

A: Any person, including businesses, individuals, or organizations, transporting jewellery valued at INR 50,000 or more within India needs to generate an e-way bill.

Q2: What information is required to generate an e-way bill for jewellery?

A: The information required for generating an e-way bill for jewellery includes:

- Sender’s details (name, address, GSTIN)

- Receiver’s details (name, address, GSTIN)

- Description of the jewellery (type, weight, karat, etc.)

- Quantity of the jewellery

- Value of the jewellery

- Place of origin

- Destination

- Mode of transport

- Transport document number (if applicable)

Q3: What happens if an e-way bill is not generated for jewellery?

A: Failure to generate an e-way bill for jewellery exceeding INR 50,000 in value can result in penalties. The penalty may vary depending on the value of the goods and the nature of the violation.

Q4: What are the benefits of generating an e-way bill for jewellery?

A: The benefits of generating an e-way bill for jewellery include:

- Enhanced security against theft and fraud

- Streamlined compliance procedures

- Reduced delays during transportation

- Increased transparency and accountability

- Improved tax collection

Q5: Can I generate an e-way bill for jewellery online?

A: Yes, e-way bills for jewellery can be generated online through the GST portal or authorized third-party platforms.

Q6: How can I track the status of my e-way bill for jewellery?

A: You can track the status of your e-way bill for jewellery using the unique e-way bill number on the GST portal or authorized third-party platforms.

Q7: What are the penalties for generating a false or incorrect e-way bill for jewellery?

A: Generating a false or incorrect e-way bill for jewellery can result in severe penalties, including fines and imprisonment.

Tips for Using E-Way Bills for Jewellery Businesses

- Familiarize yourself with the e-way bill process: Thoroughly understand the requirements and procedures for generating and using e-way bills.

- Invest in reliable software: Consider using specialized software or platforms designed to manage e-way bills effectively.

- Train your staff: Ensure your staff is well-trained on the e-way bill system and its procedures.

- Maintain accurate records: Keep detailed records of all e-way bills generated, including the e-way bill number, date of generation, and related documentation.

- Stay updated on regulations: Continuously monitor changes in e-way bill regulations and guidelines to ensure compliance.

Conclusion

The e-way bill system has significantly transformed the transportation of goods in India, including the jewellery sector. It has streamlined processes, enhanced security, and fostered greater transparency within the supply chain. By embracing the e-way bill system, jewellery businesses can navigate the intricacies of logistics with greater efficiency and peace of mind. Understanding the process, its nuances, and adhering to the regulations will ensure a seamless journey for the glittering treasures of the Indian jewellery industry.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Glittering Path: Understanding E-Way Bills for Jewellery Businesses. We hope you find this article informative and beneficial. See you in our next article!