Navigating the E-Way Bill Landscape for Gold Jewellery: A Comprehensive Guide

Related Articles: Navigating the E-Way Bill Landscape for Gold Jewellery: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the E-Way Bill Landscape for Gold Jewellery: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the E-Way Bill Landscape for Gold Jewellery: A Comprehensive Guide

The Indian government, through the Goods and Services Tax (GST) regime, has implemented the e-way bill system to streamline the movement of goods across state borders. This system, critical for ensuring transparency and preventing tax evasion, applies to gold jewellery as well. Understanding the intricacies of e-way bill generation and compliance for gold jewellery is crucial for businesses operating in this sector.

This comprehensive guide delves into the nuances of e-way bill generation for gold jewellery, highlighting its significance and benefits, and offering valuable insights for seamless compliance.

The Essence of E-Way Bills: A Primer

An e-way bill is a digital document generated electronically through the GST portal. It serves as a proof of movement of goods, allowing the authorities to track the transportation of goods within India. For gold jewellery, generating an e-way bill is mandatory when the value of the consignment exceeds ₹50,000.

Key Components of an E-Way Bill for Gold Jewellery

An e-way bill for gold jewellery encompasses essential details, including:

- Consignor and Consignee Information: This includes the GSTIN (Goods and Services Tax Identification Number), name, and address of both the sender and receiver of the jewellery.

- Goods Description: A detailed description of the gold jewellery, including type, weight, purity, and any relevant hallmarks, is crucial.

- Transportation Details: The mode of transport (road, rail, air, or sea), vehicle number, and the expected date and time of arrival are essential.

- Invoice Details: The invoice number and date, along with the total value of the consignment, are required for generating the e-way bill.

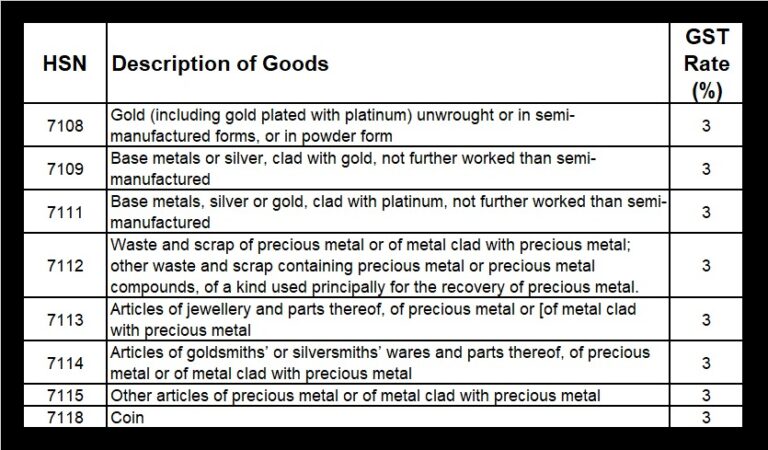

- GST Details: The GST rate applicable to the gold jewellery and the total GST amount are essential components.

Generating an E-Way Bill: A Step-by-Step Guide

The process of generating an e-way bill for gold jewellery is relatively straightforward and can be completed online through the GST portal.

- Login to the GST Portal: Access the GST portal using your login credentials.

- Navigate to the E-Way Bill Section: Locate the e-way bill generation section within the portal.

- Enter Consignor and Consignee Details: Provide the GSTIN, name, and address of both the sender and receiver of the jewellery.

- Provide Goods Details: Enter a detailed description of the gold jewellery, including its type, weight, purity, and hallmarks.

- Specify Transportation Details: Input the mode of transport, vehicle number, and estimated arrival date and time.

- Add Invoice Details: Enter the invoice number, date, and the total value of the consignment.

- Provide GST Information: Specify the GST rate and the total GST amount applicable to the jewellery.

- Generate the E-Way Bill: Once all the details are entered, click on the "Generate" button to create the e-way bill.

Benefits of E-Way Bills for Gold Jewellery

The e-way bill system brings numerous advantages to the gold jewellery industry, contributing to greater efficiency, transparency, and compliance:

- Simplified Transportation: E-way bills streamline the movement of gold jewellery across state borders, eliminating the need for multiple physical documents.

- Enhanced Transparency: The digital system provides real-time tracking of gold jewellery shipments, ensuring transparency and accountability throughout the supply chain.

- Reduced Delays: The e-way bill system reduces the likelihood of delays at checkpoints, enabling smoother and faster transportation.

- Improved Compliance: E-way bills facilitate compliance with GST regulations, minimizing the risk of penalties and legal issues.

- Enhanced Security: The e-way bill system enhances security by providing a digital record of the movement of gold jewellery, deterring theft and fraudulent activities.

Challenges Associated with E-Way Bills

While e-way bills offer significant benefits, certain challenges can arise:

- Technical Issues: Technical glitches or network connectivity issues can hinder the process of generating or accessing e-way bills.

- Data Entry Errors: Incorrect data entry can lead to errors in e-way bill generation, resulting in delays and complications.

- Compliance Complexity: The intricate regulations surrounding e-way bill generation can be challenging for businesses to navigate.

- Lack of Awareness: A lack of awareness among stakeholders about the importance and requirements of e-way bills can lead to non-compliance.

Addressing Challenges and Ensuring Compliance

To overcome these challenges and ensure seamless compliance with the e-way bill system, businesses involved in the gold jewellery industry can adopt the following strategies:

- Invest in Technology: Utilize robust software solutions designed to simplify e-way bill generation and management.

- Train Staff: Provide thorough training to staff on the intricacies of e-way bill generation and compliance.

- Stay Updated: Regularly monitor changes and updates in e-way bill regulations to ensure compliance.

- Seek Professional Guidance: Consult with GST experts or chartered accountants for assistance with e-way bill compliance.

FAQs: Addressing Common Queries on E-Way Bills

1. What is the validity period of an e-way bill for gold jewellery?

The validity period of an e-way bill for gold jewellery depends on the distance travelled. It is valid for 1 day for a distance of up to 100 kilometers, 2 days for a distance between 100-200 kilometers, and so on.

2. Can I generate an e-way bill for multiple consignments of gold jewellery in a single document?

Yes, you can generate a single e-way bill for multiple consignments of gold jewellery if they are transported together in the same vehicle.

3. What happens if I fail to generate an e-way bill for gold jewellery?

Failure to generate an e-way bill for gold jewellery can result in penalties and legal action. The penalty amount varies depending on the value of the consignment and the duration of the violation.

4. Can I modify an e-way bill after it has been generated?

Yes, you can modify certain details of an e-way bill after it has been generated, such as the vehicle number or the estimated arrival time. However, modifications to essential details like the consignee or the value of the consignment require cancellation and generation of a new e-way bill.

5. How can I track the status of an e-way bill for gold jewellery?

You can track the status of an e-way bill on the GST portal using the e-way bill number. The status will indicate whether the e-way bill has been generated, validated, or cancelled.

Tips for Smooth E-Way Bill Management

- Maintain Accurate Records: Ensure that all relevant information regarding gold jewellery consignments is accurately recorded and readily available for e-way bill generation.

- Plan Ahead: Plan the transportation of gold jewellery in advance to allow sufficient time for e-way bill generation.

- Communicate Effectively: Communicate with the consignee and transportation providers to ensure smooth coordination and timely delivery.

- Utilize Technology: Leverage software solutions designed to automate e-way bill generation and management, minimizing manual effort and errors.

- Stay Informed: Regularly monitor changes and updates in e-way bill regulations and best practices to ensure compliance.

Conclusion: Navigating the E-Way Bill Landscape for Success

The e-way bill system, while initially perceived as a regulatory hurdle, has emerged as a valuable tool for streamlining the movement of goods, including gold jewellery, across state borders. By understanding the nuances of e-way bill generation, embracing technological solutions, and staying abreast of regulatory updates, businesses involved in the gold jewellery industry can navigate the e-way bill landscape with confidence and ensure smooth operations.

The e-way bill system, through its emphasis on transparency, accountability, and compliance, plays a crucial role in fostering a fair and efficient market environment for the gold jewellery sector. By embracing this system and adhering to its regulations, businesses can contribute to a robust and sustainable gold jewellery industry in India.

![]()

Closure

Thus, we hope this article has provided valuable insights into Navigating the E-Way Bill Landscape for Gold Jewellery: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!